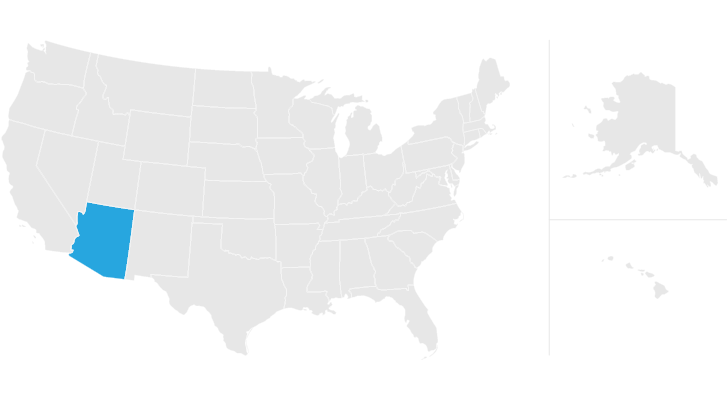

arizona estate tax laws

Statutes are laws passed by the Arizona Legislature. Probate is required in Arizona unless the decedent has a trust or listed beneficiaries for all assets.

A Guide To Estate Taxes Mass Gov

Fewer than one-half of 1 of all US.

. A pick up tax means Arizona received a portion of the Federal taxes that were. There is one exception to this rule which is for estates with personal property valued at less than 75000 and real property under 100000. States have an inheritance tax.

Federal law eliminated the state death tax credit effective January 1 2005. The top estate tax rate is 16 percent exemption threshold. Rate Range of Taxes.

By now you should understand how the gift tax works at both the federal level and at the Arizona level. The federal estate tax still applies to Arizona residents however. Banks and Financial Institutions.

Since there is no longer a federal credit for state estate taxes on the federal estate tax return there is no longer basis for the Arizona estate tax. Individuals subject to tax by both Arizona and another state on the same income may also be eligible for a tax credit. Taxes allow Arizona and other states to provide essential services and maintain order.

1 2005 Arizona no longer imposes an estate tax. Click on a link below to learn more about Arizona tax laws. Out of those states Maryland is the only one in the nation that has both an estate and inheritance tax.

However estates worth more than 117 million are subject to federal estate tax. This means that on the federal level if your estate is valued at less than 11580000 when you die then your beneficiaries will not have to pay any federal tax on their inheritance. Because Arizona conforms to the federal law there is no longer an estate tax in Arizona after January 2005.

Federal state and local governments all collect taxes in a variety of ways. There is no Arizona estate tax. Arizona Estate Planning Laws In Arizona as in other states ones estate is inherited by friends relatives or other beneficiaries according to the details in the written will.

And although there is a federal estate tax very few people typically have to pay it because it only applies to large estates worth millions of dollars. Chapter 14 - Valuation of Centrally Assessed Property. In the absence of a will state probate court decides how an estate is handled.

Laws 1979 Chapter 212 repealed the Estate Tax Act imposed a new Estate Tax and levied a tax on generation-skipping transfers of property. In this case it is known as a small estate. Some states impose taxes on your estate andor inheritance but Arizona is not one of them.

Courts and Civil Proceedings. Laws 1979 Chapter 212 repealed the Estate Tax Act imposed a new Estate Tax and levied a tax on generation-skipping transfers of property. The estate or trusts gross income for the tax year is 5000 or more regardless of the amount of the taxable income.

Chapter 12 - Property Classification. Chapter 11 - Property Tax. THIS TITLE HAS BEEN REPEALED.

Nonresidents may also exclude income Arizona law does not tax. In Arizona for example gasoline is taxed at 18 cents per gallon sales tax is at 56 percent and beer is taxed at 16. In the US there are only 12 states plus the District of Columbia that currently have an estate tax.

The Ohio estate tax. Part-year residents should exclude income Arizona law does not tax. Entire Arizona Revised Statutes.

The Arizona estate tax return was based on the state death tax credit allowed on the federal estate tax return. The estates Arizona taxable income for the tax year is 1000 or more. The trusts Arizona taxable income for the tax year is 100 or more.

Chapter 13 - Valuation of Locally Assessed Property. Furthermore estate gifts to beneficiaries while the owner is alive are subject to the federal gift tax. If you live in Arizona your estate will not be subject to an estate tax at the state level.

Arizona has neither an estate tax a tax paid by the estate nor an inheritance tax a tax paid by a recipient of a gift from an estate. There is a base tax and additional tax with an incremental rate set per the excess valuation. If your estate is valued above 1158 million youll only be taxed on the amount that exceeds this number.

No tax is due unless the amount exceeded the lifetime exemption. The majority of statutes relating to property tax are referenced in Title 42 Taxation. However in addition to the federal gift estate and generation-skipping taxes some states have their.

In Arizona for example gasoline is taxed at 18 cents per gallon sales tax is at 56 percent and beer is taxed at 16 cents per gallon or less. Chapter 15 - Assessment Process. Please see Arizona Credit Form 309 for.

Federal estate tax return due nine months after the individuals death though an automatic six-month extension is available if asked. Federal estatetrust income tax return due by April 15 of the year following the individuals death. As of Jan.

Citizens will have to pay estate tax. Nevertheless the estate is taxable only on the amount that exceeds the valuation threshold. Form 709 gift tax return must be filed to show the 5000 amount over the exemption.

Nonresidents are subject to Arizona tax on any income earned from Arizona sources.

Tax Law And Policy Concentration University Of Arizona Law

What Are The Inheritance Rules In The Usa Us Property Guides

5 Things You Should Know About Probate Law In Arizona

Transfer On Death Tax Implications Findlaw

States With No Estate Tax Or Inheritance Tax Plan Where You Die

4 Types Of Assets That Are Subject To Probate B H Pllc

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Four Ways To Avoid Probate In Arizona Mushkatel Robbins Becker Pllc

Arizona Estate Tax Everything You Need To Know Smartasset

What Is Arizona Homestead Act 5 Most Common Questions Answered

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Corporate Income Tax Rates And Brackets Tax Foundation

Arizona Inheritance Laws What You Should Know Smartasset

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

The Revised Arizona Homestead Exemption Is The Homestead Exemption Still Beneficial Provident Lawyers